North Dakota broadens farm home tax exemption, but proof of ag income now required

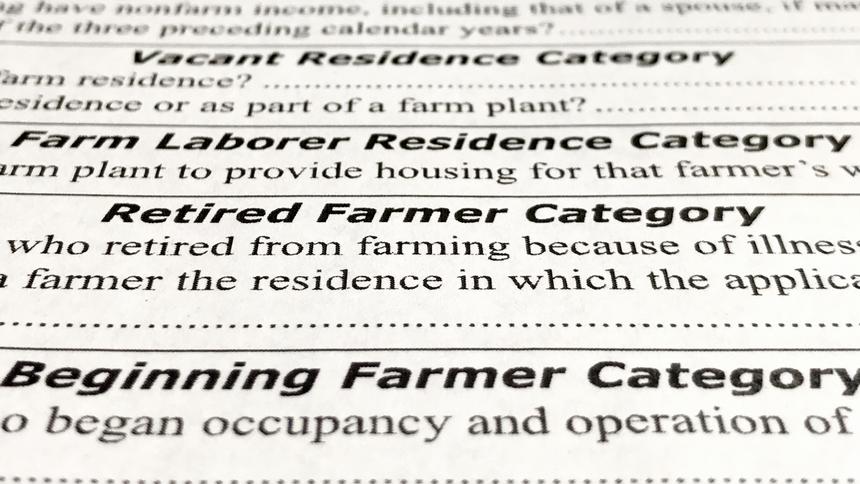

FARGO — A popular property tax exemption for farm homes granted to more than 11,000 rural North Dakota residents has been changed to broaden eligibility but require annual farm income verification to qualify.

The tax exemption, which is granted to rural homeowners who meet the legal definition of a farmer, was created in response to the farm crisis of the 1980s.

The North Dakota Legislature changed the income test to qualify for the property tax exemption. Eligibility used to require that 50 percent or more of a farmer’s net income came from farming activities.