High Profile Bills Find Tough Sledding In Wyoming Legislature

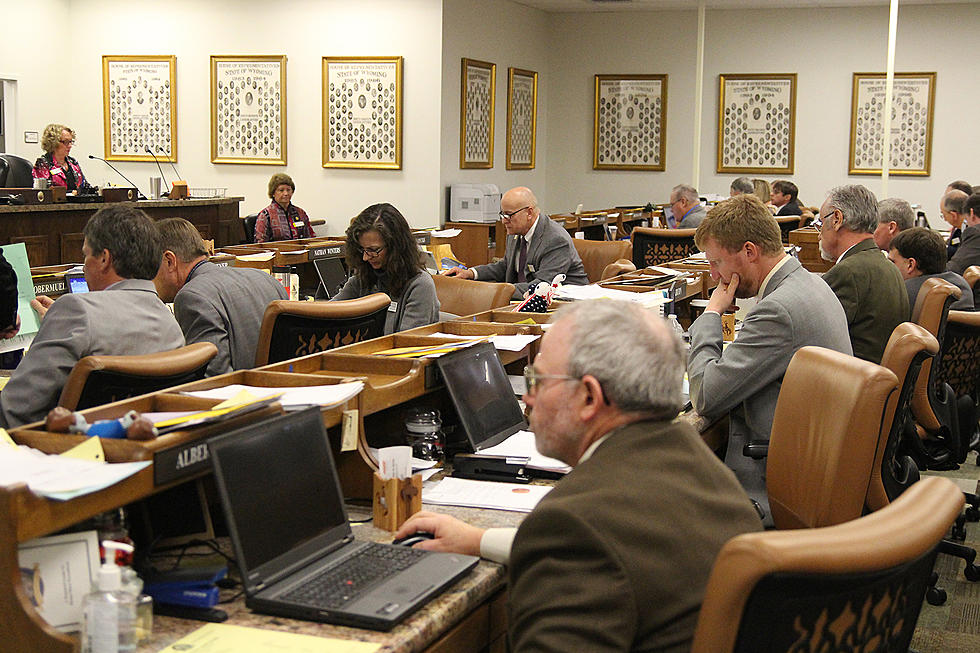

The 2019 session of the Wyoming Legislature may be remembered as one where high profile bills–especially tax bills–were not met with much enthusiasm.

A proposal to implement a personal and corporate state income tax, sponsored by Rep. Cathy Connolly [D-Albany County] died in the Wyoming House Revenue Committee, despite claims it would have raised around $200 million per year for state schools.

Even friends in high places couldn’t save House Bill 220, a corporate income tax bill that would have targeted large, out of state companies like Walmart. The measure would have levied a tax of up to 7 percent on companies with over 100 shareholders. It was supported by much of the legislative leadership, and it sailed through the House by a 42-16 margin. But conservatives opposed to the idea of any state income tax, the business community, and representatives of Walmart and other companies came together to fight the bill in a Senate committee, and it died without ever making it to the Senate floor.