Gianforte Proposes Historic Tax Cuts for Montanans

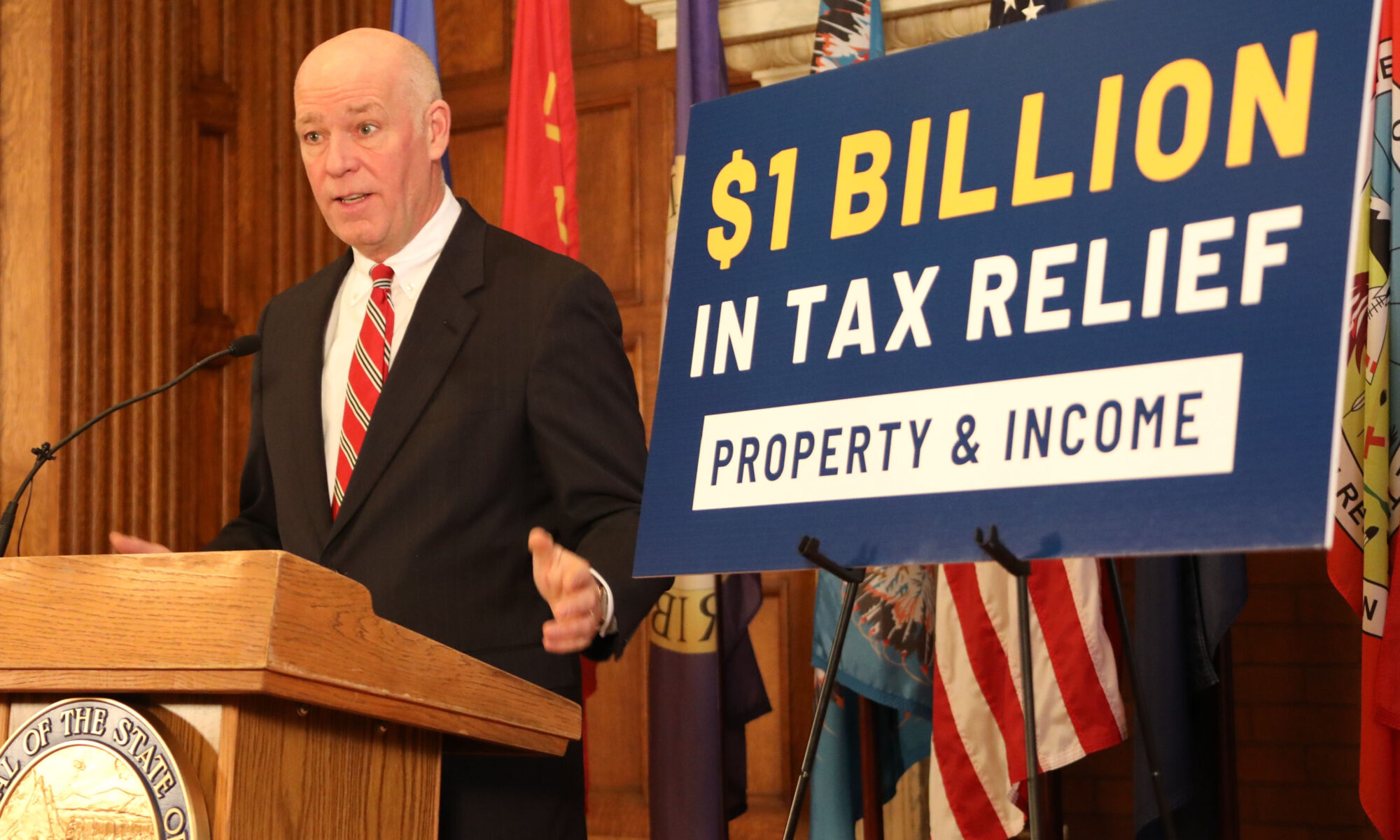

Governor Greg Gianforte and Grover Norquist, president of Americans for Tax Reform, held a press conference at the State Capitol today to outline Gianforte’s ambitious proposals for permanent tax relief for Montanans. The governor introduced plans to reduce the state’s income tax rate and deliver permanent property tax cuts for homeowners on their primary residences.

“I’m pleased to be joined today by Grover Norquist, who has been a strong advocate for limiting the size and scope of government,” said Gov. Gianforte. “With his support and the backing of key legislative partners, I’m confident we can deliver historic tax cuts for Montanans once again.”

As part of his Path to Security and Prosperity budget for the next biennium, Gov. Gianforte proposed Montana’s largest tax cut in state history. This includes a plan to permanently lower the income tax rate for most Montanans, alongside expanding the earned income tax credit to encourage work and provide additional support for lower- and middle-income workers.

Since 2021, the governor has worked to simplify Montana’s income tax structure, reducing the number of brackets from seven to two and lowering the top rate from 6.9% to 5.9%.

“The rest of the country is looking at doing exactly what you’re doing here: lowering income taxes and making them more understandable,” Norquist remarked, emphasizing the effectiveness of the simplified approach.

Gov. Gianforte also introduced a proposal to permanently reduce property taxes for Montana homeowners and small businesses, as recommended by his bipartisan Property Tax Task Force. The homestead rate cut would reduce property taxes for homeowners by 15% and for small businesses by 18%, directly benefiting 215,000 homeowners and 32,000 small businesses.

“This is a top priority for me, and to make it a reality, the bill establishing the homestead rate cut must become law by mid-February,” the governor emphasized.

Norquist cautioned against using state funds to offset local governments’ rising spending. He compared the practice to trying to solve one problem by creating another: “It’s like trying to swallow a tapeworm to eliminate another tapeworm,” he said, urging cities to manage their budgets more effectively instead of relying on state support.

Gov. Gianforte’s tax relief proposals aim to provide permanent financial relief to Montana residents while simplifying the state’s tax code and reducing the burden on families and small businesses. With bipartisan backing and key legislative support, the governor is pushing for swift passage of these measures in 2025.